As published in Toledo Business Journal - July 1, 2013

Owens Community College’s Findlay campus

Site selectors

offer guidance for

area job creation

A number of professionals traveled to northwest Ohio this past spring as part of an effort to improve economic development in the area. Most of these professionals are site selection consultants whose clients are corporations interested in finding locations for new facilities. These facilities may include manufacturing plants, distribution operations, research and development centers, headquarters, and other operations.

The visiting consultants were the

featured speakers at a program

organized by the Regional Growth

Partnership (RGP). Attendees

were

economic development

professionals from counties and

cities

throughout the region. The

event was held at Owens

Community

College’s Findlay

campus. Gary Thompson and

Todd Dickerson, RGP

vice

presidents, organized the event.

The site selection consultants

discussed the process that they

employ in working with a client. In

describing this process, the

image

of a funnel was used. At the top

of the funnel, dozens and

even

hundreds of possible site locations

are entered. As the

process

continues, only a few locations exit

the bottom of the

funnel.

A number of the consultants

described their work as a process

designed to eliminate sites. They

explained that for almost all

projects there are always a large

number of site options. They

further explained that with the

large number of options, much of

the work involves finding reasons

to eliminate potential sites.

The consultants spent their time

before this group of area

economic

development professionals

sharing their insight on how

communities in the region can

increase their chance of having

a

local site selected for a

corporate project.

Site Selectors: Critical location factors of NW Ohio and SE Mich

An example of a web-based tool that highlights critical location factors (CLFs) for northwest Ohio and southeast Michigan and also provides supporting data and information can be found at www.toledobiz.com/propertyscout_regionalassets.html

This tool is being provided by Toledo Business Journal as part of the Decision Data component of the regional Industrial Property SCOUT system. A “skeleton” outline has been put in place for this critical location factor tool. It will be updated as additional data and information concerning these key regional assets and strengths is obtained.

The Industrial Property SCOUT system contains databases of key decision data and includes separate software that can be customized for any county in the region. It has been deployed on the websites of a number of county economic development organizations in northwest Ohio and has been offered by RGP to local economic development organizations in southeast Michigan.

RGP and JobsOhio are currently providing the funding for any county/city in the region that chooses to advance the information on its website with the SCOUT system.

The site selection consultants

described the work they do in

order to select a site for a facility

and provided examples of

projects

and clients. Each discussed a

process that involves a

significant

amount of time spent gathering

data and information.

Using this

data, a series of detailed financial

analyses are

prepared on site

alternatives.

Early in the process, the

consultants screen potential site

options for critical location factors

(CLFs), explained Dan

Foster,

senior managing director,

Newmark Grubb Knight Frank. As

the project advances, a modeling

approach is often used in order

for the consultant and client to

examine the potential for

profitability and return on

investment between the

various

options. Examination of

financial performance is also

accompanied

by an assessment of

important qualitative factors.

A winning site must offer both

financial performance capability

and meet important qualitative

factors.

Foster discussed the approach to a client project in more detail. He explained that at the beginning of an assignment, a significant amount of time is spent with personnel from the client company in order to understand the key factors that impact profitability and successful operations. Through this process, the top factors that impact a business’s operations are identified. Next, each of these factors is ranked. Then through an involved effort, a weighting is developed so that the level of the factor’s importance and impact is able to be properly incorporated in the site selection decision process. These critical location factors or CLFs drive much of the quantitative and qualitative analysis work that is done on a project.

Foster explained that these critical location factors change for different industries. He also explained that these factors may differ for companies within an industry depending on the business’s specific capabilities and needs.

Foster then used the funnel example to discuss in more detail the process that many site selection consulting firms use. There are also many corporations that do this same type of work without the use of a consulting firm when they are making decisions on where to place new investment in their existing network of facilities and possible new operating locations.

Foster described the funnel process as a multi-phased approach. In Phase One, a large number of site location options are screened. During this phase, a significant amount of data from national databases and from area economic development websites and other sites is pulled together.

The consultants explained that during this first phase, they do not contact economic development agencies or individuals at site locations. They often work “24/7 hours” and professionals at potential site options are not aware they are being considered.

This part of the site selection process has important implications for communities interested in increasing their chances of winning new investment projects.

During the data gathering work of Phase One, the key quantitative and qualitative factors that will drive a facility investment decision are known by the business and their consultants. These critical location factors are used to gather specific data. This information is used to screen a large number of site options and to eliminate many in order to get the list of finalists to a manageable level.

Data used from a national database may not accurately reflect the real situation with a site option. Site selection consultants attempt to correct this by trying to obtain more accurate data and information from area economic development websites and other sites.

An example of data from a

national database that

negatively

impacts northwest

Ohio and southeast Michigan

industrial buildings

and sites

is provided in the sidebar to

this article headlined

“Quality

data can increase job

creation.”

Improve web info

One of the recommendations

that site selection consultants

have

offered is that area

economic

development

organizations

improve

the

information on their

websites.

Site Selectors: Quality data can increase job creation

There are national databases that many corporate professionals and site selection consultants use to do the Phase One screening work for a site selection project. These professionals take the time early in a project to attempt to obtain more accurate data. If they are able to obtain more accurate data from an economic development website, they will use this information instead of the national database. They have learned through experience that more accurate data will impact the results of an analysis.

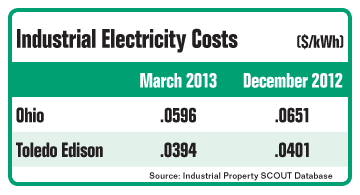

As an example, for a corporate industrial project where energy costs are a critical location factor (CLF), a national database of industrial electricity rates can be obtained from the US Energy Information Administration (EIA). Recent data from this source provides the average industrial electricity cost per kilowatt-hour (kWh) in Ohio (which is the lowest geographical level for which information is provided). Site selectors and analysts at corporations are able to use this data at an early stage of the project in order to incorporate the cost differences of sites in competing states.

The EIA data for March 2013 shows the average industrial electricity cost for Ohio at $.0596/kwh. However, the actual average industrial rate paid by northwest Ohio industrial customers of Toledo Edison for the same period was $.0394/kWh (Source: Industrial Property SCOUT database).

Using the EIA Ohio data currently results in a 51% cost penalty being placed on industrial buildings and sites in northwest Ohio where Toledo Edison is the electric utility. This cost includes both generation and distribution cost components. Site selection professionals who use the EIA Ohio industrial electricity cost database figures place a significant penalty on industrial site options in northwest Ohio by incorporating the higher EIA data that is not accurate for northwest Ohio and southeast Michigan.

The reality is that industrial customers of electric utilities in northwest Ohio currently have electricity costs that are extremely competitive. This is a significant change from years past. There are a large number of industrial companies in the region that, as a result of changes in Ohio utility regulatory practices, are now able to contract for very low generation rates from utilities in the area or around the country. They are then able to combine the generation costs from their selected provider with low distribution costs from an area utility to result in a low total industrial electricity rate.

Unfortunately, industrial sites in northwest Ohio and southeast Michigan may be eliminated during the Phase One screening for those projects that are high industrial electricity users and where site selectors only have access to the EIA Ohio data.

Prior to undertaking a project

to

upgrade its website,

Sandusky

County Economic

Development

Corporation

(SCEDC) assembled

a group

of site selection

consultants to attend a focus

group session.

During this

session, these consultants

advised

that during a

project

they often

worked 24/7. They

explained that

they often go

to economic

development

websites in an

attempt to

obtain more

accurate

data.

They also shared that during

the early phases of a

project,

economic development

professionals are often not

aware

that one of their

buildings or sites

is being considered.

During this focus group session,

these site selection consultants

advised that they may eliminate

a site option if it is difficult

to

obtain needed data. In contrast,

they spend more time with

areas

where the information is easier

to

obtain. “If you want more

development projects, make it

easy for us to do our jobs.”

They

strongly encouraged

improvement

of the information

on area

economic development

websites.

Unsupported claims

Foster emphasized the importance of backing claims made on economic development websites with hard data and supporting information. He explained that every community in the country claims that they have an excellent “quality of life.” Further, many communities and regions claim that they are the right place for certain target industries, but then do not offer hard data and supporting information.

Foster encouraged attendees to understand the unique strengths of their communities and their development site options, target the industries where these strengths are most beneficial, and then provide data and information on their website that supports their case.

“Your websites have to be set up understanding what information we are looking for. Build out your website to identify and highlight your strengths. Then, it is important that you prove your claims about assets and strengths by providing supporting data and information that we can obtain,” Foster emphasized.

Website info for critical location factors

Site selection consultants work in teams with other members of their consulting firm and also with individuals employed by the client. For companies that do not employ a consulting firm, a team of cross-functional employees work together on a site selection project team.

During a project effort, much of the work that takes place involves the elimination of site options. Sites that avoid elimination and continue through the process have favorable financial performance and qualitative factors that are supported by hard data and information about the location. They become “championed” by member(s) of the team as a result of this hard data and information about the site location.

Foster’s encouragement to provide hard data and supporting information for critical location factors in the region can be very important for a site option in northwest Ohio or southeast Michigan. This hard data and information will give team members a tool and a resource that they can use to champion a potential site location and keep it from being eliminated during this involved process.

Critical location factor (CLF) data and information about a building or site location that can be shared by team members during a presentation to client decision-makers is especially important.